The most important thing to know when it comes to budgeting is that every dollar has a job.

The cash envelope system is a great way to see how much money you have and put your money to work by allocating specific amounts for spending in each category.

How To Use The Cash Envelope System

Since budgeting is about knowing where your money is going; the cash envelope system is very effective. In fact, you can end up saving more money and get better deals according to this CNBC Make It article!

CREATE A BUDGET

Before you can begin the cash envelope system, you’ll need to create a budget.

If you are just getting started with a budget, then I recommend reading this blog post to get a feel for the resources that are out there, learn a few different styles of budgeting and understand why goal setting is important when budgeting.

I use the cash envelope system because it’s harder for me to spend cash than it is for me to swipe a card.

The action of breaking a large bill such as a $100 or $50 bill causes me to think twice before I make a purchase.

I also enjoy the cash envelope system because I’m able to create my own custom sinking funds for my variable expenses.

You’re probably asking yourself… “What are sinking funds and how do I put them to use?”

Well, simply put they’re separate funds you create to contribute a small amount of money towards each time you get paid.

These funds are meant to be set aside, accumulating money that you’ll use to cover a specific yet expected upcoming expense.

I’ll provide some examples within this blog post, so you know exactly what I’m talking about but for now, let’s focus on the next step to help you successfully use the cash envelope system.

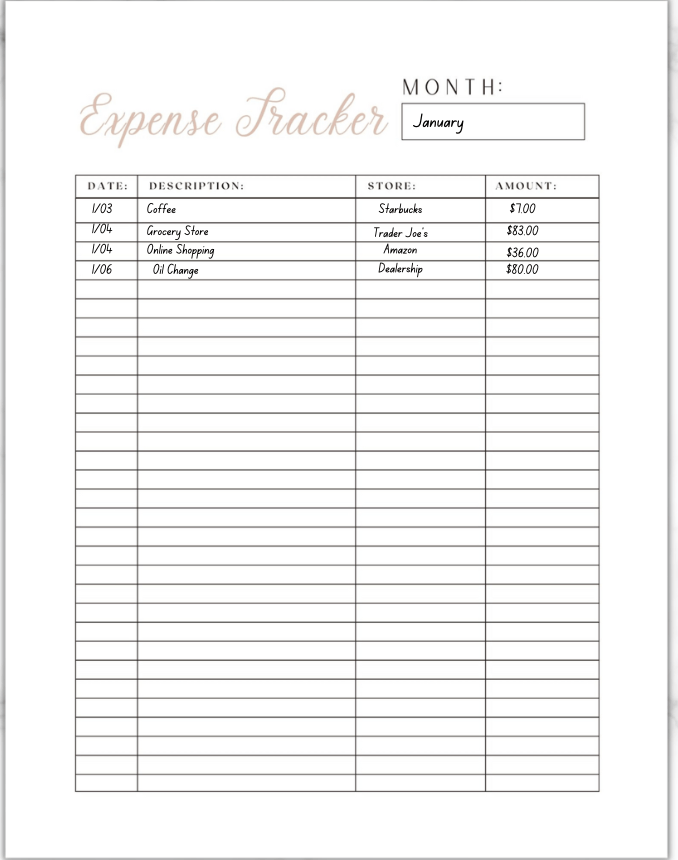

TRACK YOUR EXPENSES

Once you’ve created your budget you will need to track your expenses. You’ll likely want to hang on to receipts but if not, this will require you to analyze previous bank statements.

You can use highlighters to highlight each description on your tracker and assign a color to a ‘category’ which will coordinate with the sinking fund you will create for the cash envelope system.

CATEGORIZE AND SET SPENDING LIMITS

Now that you have your budget and a better since of how you are spending, you’re ready to start getting your categories together.

Look at your expense tracker then note where you see the bulk of your spending. This will be your road map for determining the sinking fund for areas you spend the most.

Once you’ve gotten your categories together you will need to set spending limits. Each time you get paid you will add a designated amount to the sinking fund and only spend the amount in the envelope for that category.

For example, if one of your sinking fund categories is grocery, review your expense tracker to see how much you typically spend and create a cash envelope for grocery. If you add $125 for grocery, then that will be your spending limit for groceries until you get paid again.

PAYING BILLS

I think the biggest misconception about cash stuffing is that many people think you must run to the bank and take out cash every time a bill is due.

Thankfully, that is not the case. I recommend paying all fixed bills electronically and managing all variable expenses with cash envelopes.

Examples of fixed expenses are:

- Rent/Mortgage

- Car note

- Insurance premium

- Cell phone bill

- Internet/cable

Some sample variable expenses are

- Eating out

- Clothes

- Household items

- Gas

- Entertainment

EXAMPLE SINKING FUNDS FOR CASH ENVELOPE SYSTEM

Car Maintenance

Reliable transportation is necessary especially if you don’t live in a big city where you could utilize the metro.

Therefore, you need to take good care of your car and regularly pay for oil changes or new tires. This is especially important because the last thing you want is to have a big bill because you didn’t do routine tune-ups.

If you want your car to run well, naturally you will need to take care of it. Saving a little each month for routine car maintenance will save you a lot of money.

Home Repair

If you’re a homeowner, there will come a time where something needs to be replaced.

Although your sinking fund will not cover any major home repairs (you’d use your emergency fund for that) it will cover small things and you can put a little money aside for any vanity purchases you want to make to spruce up your home.

Having a sinking fund that can cover those costs comes in handy and you will be thankful.

Clothes and Shoes

This one is especially important if you have kids. They grow and when they go back to school, they likely need new clothes.

This isn’t only for parents; you deserve to look and feel good too.

If a new outfit will help you achieve this, then put some money aside.

You will be able to walk with a little extra pep in your step knowing you look good! Confidence is everything and it makes all the difference in your daily life.

Pets

We all love our fur babies and want to ensure they’re able to lead long healthy lives. This means it’s going to cost money.

Between annual visits to the vet, grooming, food, and treats. The cost of taking care of pets adds up!

They’re a huge responsibility which is why contributing a small amount of money each month will certainly help make things easier on your wallet.

The Holidays

Giving is such a beautiful thing! Gifts can be costly but if you save a little every month instead of relying on credit cards when shopping, you will save yourself a whole lot of trouble.

Additionally, it’s a good idea to consider having a separate sinking fund for gifts you will buy people throughout the year.

For instance, birthdays, Mother’s Day, Father’s Day, even baby showers, and graduations you plan to attend.

Travel

This one is my favorite! Setting aside money each month for an upcoming vacation is essential. Part of your planning for the trip should include the money you want to spend while you’re away.

I love having a sinking fund for travel because this one is fun money.

You might want to get some new clothes, before the trip too. Therefore, you need to include money for that in this sinking fund.

When you’re on vacation and you have a sinking fund, you will be able to spend guilt-free because that is exactly what the money is there for – your enjoyment!

Annual membership dues

If you are a part of an organization then you know you will have to pay a fee in order to be an active member.

Why not set aside a little money each month to prepare for those annual dues? This way when the time comes you are ready and don’t even have to think about it!

The same is true for the renewal of places like amazon prime/Sam’s club if you pay annually.

DOES THE CASH ENVELOPE SYSTEM WORK FOR EMERGENCIES?

There is one thing you need to understand about sinking funds and the cash envelope system. It seem a lot like an emergency fund but they’re not the same.

You never know when you will need to use the money in your emergency fund. Typically, you save around 3-6 months of living expenses for emergencies.

In a perfect world it would be nice to never have to touch that money. Unfortunately, we do not live in a perfect world and life happens meaning you will have to tap into your emergency fund.

The cash envelope system helps us prepare for future expenses. In some instances, you are excited to use this money.

My favorite sinking fund is for travel! When I take a trip, I like to buy new clothes, get my hair done, and eat a ton of good and sometimes expensive food.

This means I will have to save in advance so I will be able to afford and enjoy my vacation.

This is the key benefit to creating a sinking fund. It also means you don’t have to reach for your credit card.

WHERE TO STORE YOUR CASH ENVELOPE SYSTEM

Having a budget binder is great for storing your cash envelope system. You can have different budget binders for different types of savings goals.

For example, you can have a budget binder for long-term saving goals where you stuff envelopes for investing, new home, new car etc.

You could have another budget binder for short-term savings goals. A great example of a sinking fund that would go into this budget binder is back to school.

You should never keep large amounts of money in your home. Once each envelope reaches $1,000 its best you unstuff that envelope and deposit it into the bank.

If you have a sinking fund that is for more long-term savings goals, you can use a place holder to represent the money that is in that sinking fund even though that money is already in the bank.

Consider opening a HYSA savings account with your bank. In doing so, you will need to keep a detailed ledger that way you will be able to distinguish how much money is for a specific sinking fund.

There are some banks that allow you to open multiple accounts so definitely do your research and try different methods until you land on something that sticks.

For a closer look at how I’ve set up my cash envelope system for 2023, check out this video!

Visit my Etsy shop if you’d like to purchase envelopes handmade by Money Multiplied.