Sharing is caring!

To successfully manage your finances, you will need to create a budget.

It doesn’t matter who you are or how much you make – everyone needs a budget. Regardless of if you make $350,000 or $35,000 a year.

The simple fact is you need to know where your money is going.

In this blog post, I will walk you through everything you need to know in order to create a budget as an absolute beginner.

HOW TO START A BUDGET

The budget you create is designed to help you achieve your financial goals. These goals look different for everyone.

Maybe you graduated college a few years ago and want to pay off student loan debt.

Perhaps, you want to buy a house soon or have been considering a work sabbatical. Whatever your goal is, you need to first determine your why and use your budget to figure out how you plan to organize your money so your goals materialize.

SET YOUR GOALS

Knowing the importance and the ‘why’ around your budget is the first and crucial step when trying to create a budget.

Living paycheck to paycheck is no fun which is why I decided to create a budget. I currently use the cash envelope system for budgeting.

To learn more about this method, check out this blog post:

Read more: How to use the Cash Envelope System

For many, budgeting can be a bit overwhelming which is one of the reasons people avoid it altogether.

However, your money will run you if you don’t create and stick to a budget.

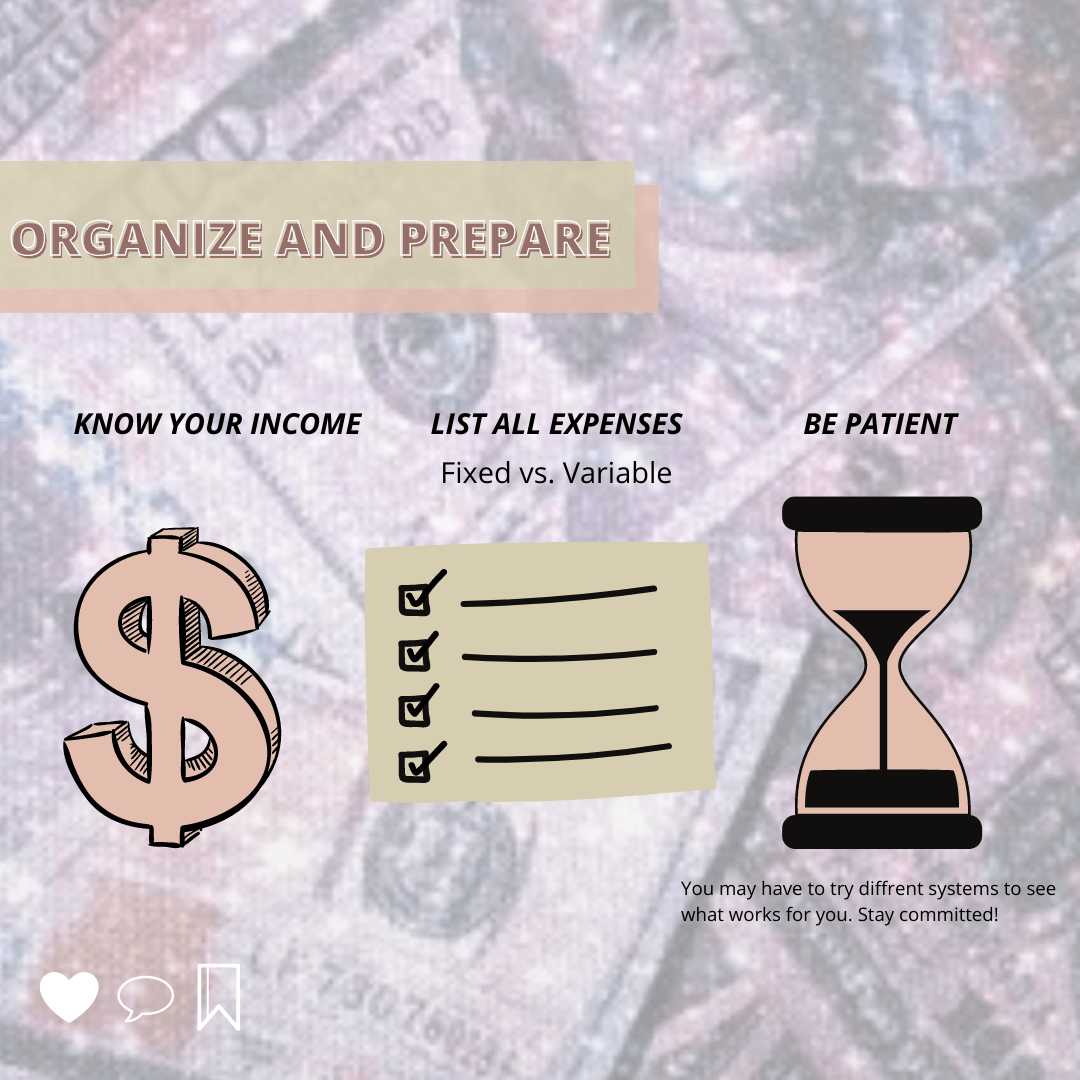

STEP 1: TAKE A LOOK AT YOUR INCOME

After you’ve determined your why and set your goals, the work begins!

You’ll need to know how much money you make. This is your income.

The salary you make from your 9-5, your side hustle business, alimony, child support, etc. These are all considered sources of income.

Make a list of all the sources of income you have and write down how much you typically make. If you are unsure on this part, then look at previous bank statements. Take the average if the amount you receive varies from month to month.

STEP 2: ADD MONTHLY EXPENSES

Create a list of your monthly expenses. There are two different type of expenses you need to know. Fixed and variable.

Fixed expenses are those bills that you must pay each month and typically costs the same. Examples of fixed expenses are rent/mortgage, insurance, car note, phone bill.

Variable expenses are the bills you don’t necessarily need to pay but they’re expenses you should still budget for nonetheless. Examples of this are gas, grocery, clothes and entertainment.

As a beginner, I recommend taking a look at past bank statements and analyzing them to get a picture of your spending.

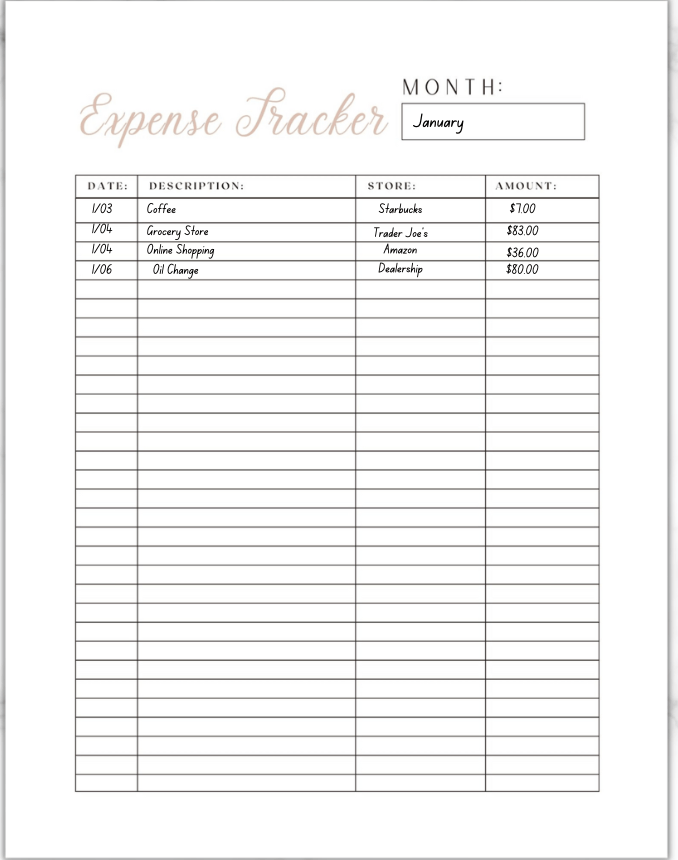

Now that you know what money is coming in and going out, an important part of having a successful budget is tracking your spending. This will help keep you organized too.

You can record your daily spending using pen/paper or a spending tracker like the one below.

This is a great habit because at the end of the month, you’ll be able to look at your statement and compare it to your spending tracker and note any discrepancies.

STEP 3: REVIEW YOUR BUDGET REGULARLY

Your budget is going to change, that is a fact! You’ll have new goals, reach milestones and need to tweak your budget so that it is relative.

It doesn’t matter how your budget changes; you should get in the habit of reviewing your budget regularly.

WHAT METHOD OF BUDGETING IS BEST?

There are different methods you can take when you are budgeting as a beginner. The bottom line is you need to know what money you have coming in (income) and what money is going out (expenses).

There are so many apps, templates and even your online bank that likely has some sort of feature that allows you to create your budget.

Like I’ve said, I like cash envelopes. I myself got started with these when I was working in the service industry. You can make your own or support small business owners and purchase cash envelopes from online marketplaces like Etsy.

As you begin, consider trying out different methods or even a combination of both.

Personal finance is personal and it’s up to you to determine which method you want to make work.

What if you don’t make enough

If you find that you aren’t making enough to cover your expenses, this means you have two options. You need to find where you can cut back or increase your income.

Your next option is to figure out a side hustle. This can be you getting a part-time job or putting your skills and talents to work for other people.

You can achieve every financial goal.

Though, it first begins with creating a budget and staying the course. Remember to be patient.

Figuring out a method that works for you takes a lot of trial and error, but I promise if you don’t give up, it will be worth it!