A popular method to paying down debt is the debt snowball method. Becoming debt-free is a major financial milestone, though when you’re in debt it can seem impossible to pay it down. Nonetheless, debt is not a life sentence. There are different methods you can apply to help accomplish debt freedom, one of them being the debt snowball method. This blog post will explain the method but first, there are a few things you need to do before starting.

BEFORE GETTING STARTING

Prior to beginning the debt snowball method, you need to save 3-6 months of expenses in an emergency savings fund. This is important. Having money set aside for an unexpected expense is the safety net preventing you from accumulating new debt. After all, we are trying to pay off debt. Opening a high yield savings account (HYSA) for your emergency savings fund should be a priority. Do this before attempting to pay down any debts.

Additionally, you want to revisit your budget and see where you can afford to cut expenses. Ask yourself are you able to free up any extra money by cutting subscriptions and reducing miscellaneous spending. Whatever money you’re able to recover from taking a closer look at your budget is going to be helpful when chipping away at debt.

THE DEBT SNOWBALL METHOD

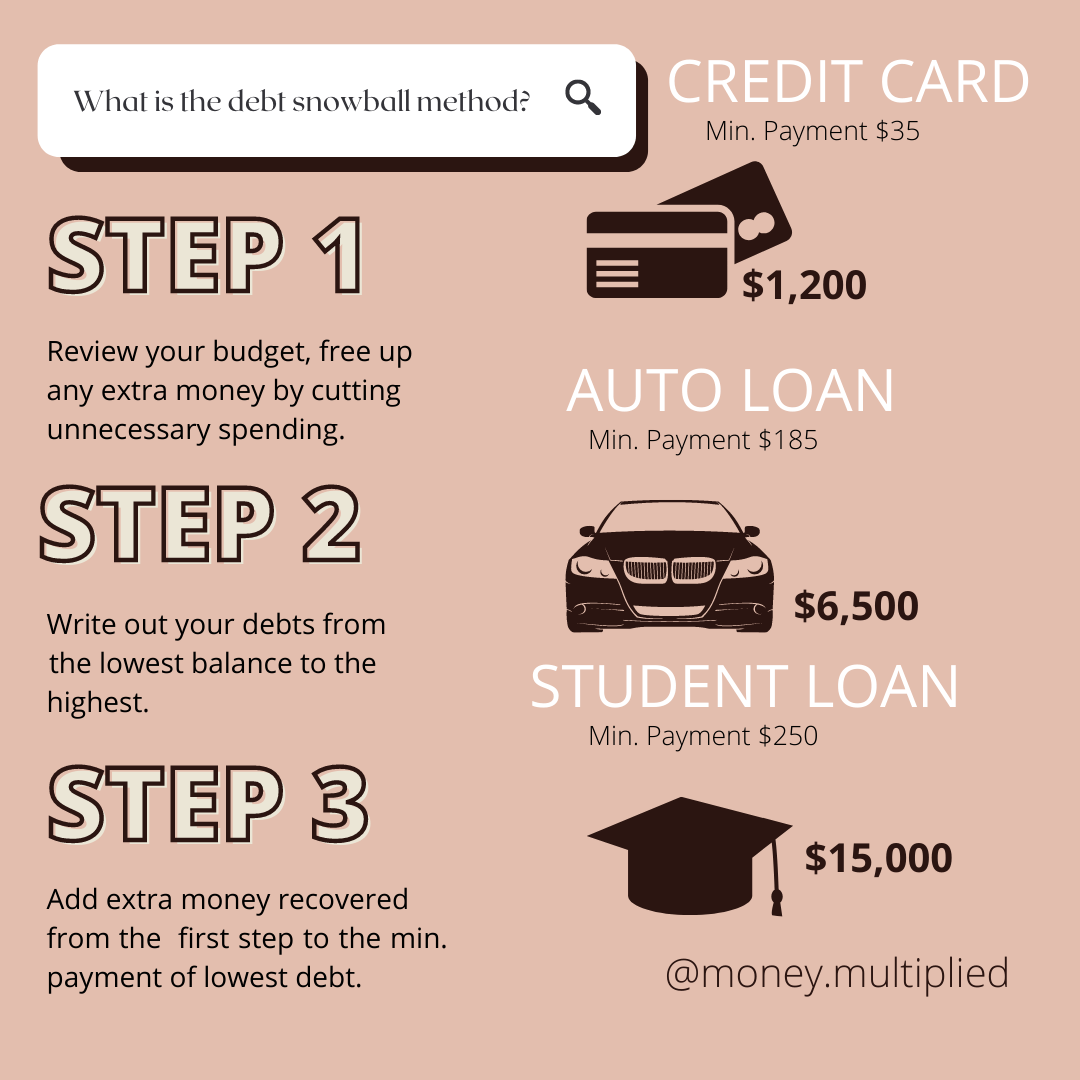

The debt snowball method was first popularized by personal finance advisor Dave Ramsey. The idea is that paying off the smallest debt first will feel like a big win and encourage you to keep paying down all of your debt until eventually, you are debt free. So, how does it work? You would first start by listing out your debts (smallest to largest) and their minimum payments regardless of the interests.

See example below:

In this example, the combined total debt not taking interest rates into account would be $22,700. The smallest debt is on the Discover credit card and the minimum payment is $35.

WHY DEBT SNOWBALL?

Using the debt snowball method means that you’d apply the minimum payments to all debts but pay more toward the Discover card. This is where the extra money you recovered from taking a closer look at your budget comes in handy.

Let’s say you were able to recover $100. You’d apply the $100 to the minimum payment making the total payment toward your Discover card $135. In roughly 9 months, your credit card will be paid off and you can move on to your next biggest debt which would be the car loan.

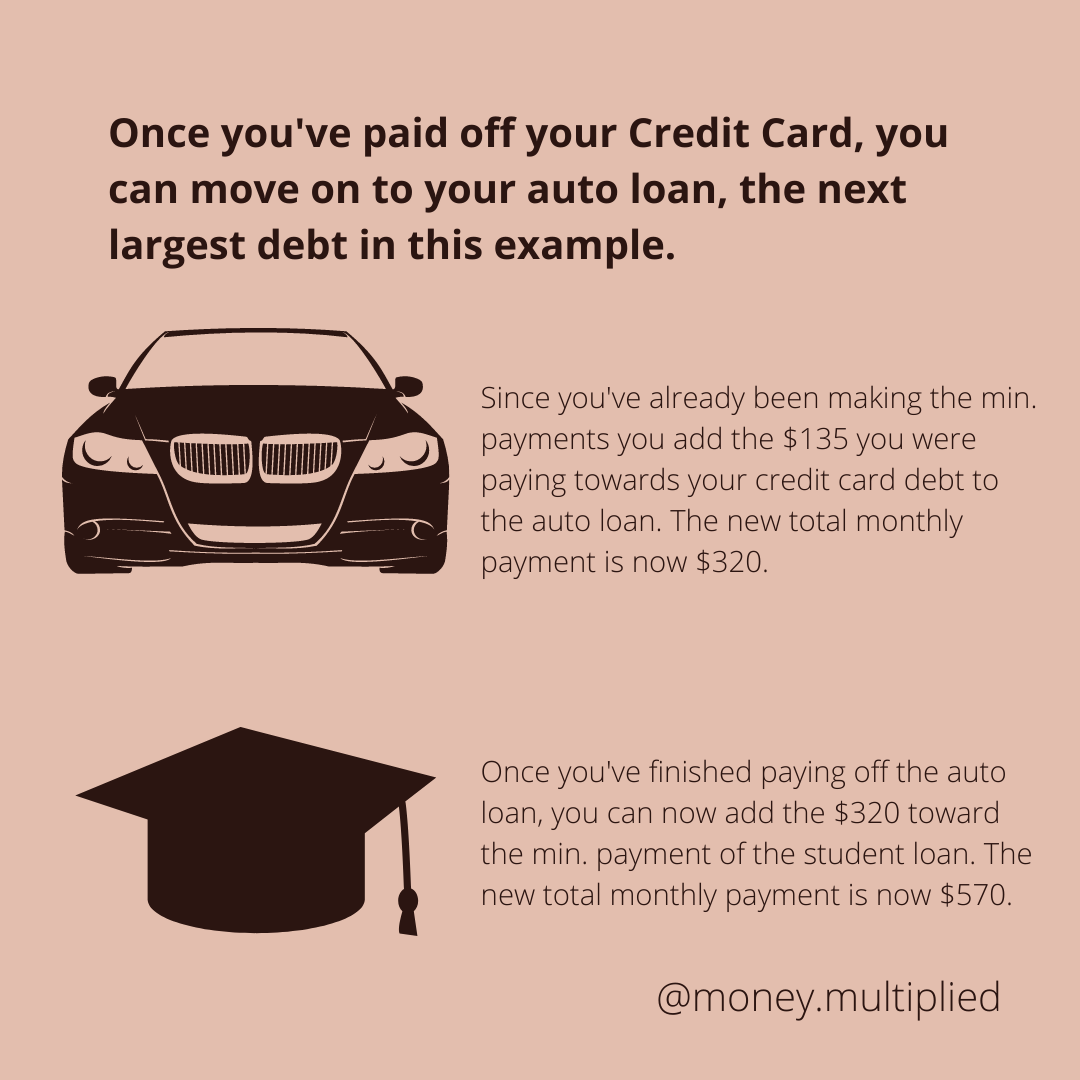

With the Discover card paid in full, you’d now use the $135 toward making payments on top of the car loan’s minimum payment of $185. This makes the total payment you apply each month $320. Once you’ve finished paying your car off, you’d repeat this same process with your student loan debt. Applying the additional $320 on top of the minimum payment of $250 making the total payments each month $570.

You must have patience and discipline! Though it is completely worth it – if you’ve found this blog post helpful, be sure to become a subscriber! I share encouragement and tips on the 1st and 15th of every month!

Great post!! Love the Debt Snowball method – it really works and helps keep you motivated 🙂

Author

It sure does, it’s the small wins that help keep you going!

I have definitely used the debt snowball method to pay off debt. I need the motivation as I go to keep me feeling like I’m JUST paying down debt and never reaching the bottom. Thanks for sharing this!