Now, more than ever people have been faced with hardships caused by the coronavirus pandemic. It seems like it’s never-ending. Every day there is a new headline and for some a paycheck is unpredictable. According to Jungle Scout’s Consumer Trends Report 56% of American consumers are living paycheck to paycheck. The economy has shifted and now might be the perfect time for you to consider the paycheck budget method.

What is the paycheck budget method?

It is exactly what it sounds like, each time you get paid you create a new spending plan. A lot of people choose to create their budget at the beginning of each new month. Though if you are new to budgeting then this can be difficult because sometimes variable expenses can be unexpected. For instance, you might find that you need to make an additional trip to the grocery store. The paycheck budget is great for just about anyone especially if you find yourself in the following situations:

- You live paycheck to paycheck

- Have a regular source of income

- Get paid multiple times a month

- Are unsure of where your money goes each month

Is the paycheck budget method right for you?

If you feel that you identify with any of the above, then this method of budgeting will probably work well for you. So, let’s get into the step-by-step guide to successfully use the paycheck method of budgeting.

Step 1: Budget Calendar

The first thing you will want to do is print off a fresh calendar for the new month. Even though you might not be creating a monthly budget; this will be extremely helpful for filling in when each bill is due. I like to also use it for planning out upcoming purchases. For instance, if there is something I’ve been wanting I will save and set a date for when I will buy the item. I call these “spend days”. Let’s be real…a lot of people don’t budget because they feel like it means they must sacrifice every little penny. There is some truth to this but keep in mind a budget is nothing more than a spending plan. Furthermore, your budget should have built-in spend days.

Step 2: Write out your bills and expenses

I think people like to group bills and expenses in the same category. But an expense doesn’t necessarily have to be a bill and can often be eliminated from your budget altogether if necessary. An example of this is hair and nail maintenance. This is an expense. You should include it in your budget, but it is something you can do without. Bills should be a priority at all costs. Think of your mortgage/rent for example, this is a bill. You need to pay this to provide safe housing for yourself and or your family. Before we focus on organizing your bills using the paycheck method of budgeting, let’s first further understand the types of expenses.

Related content:

The different types of expenses

There are two types of expenses. First, you have the fixed expenses. These are super important and typically you know exactly what to expect when paying them each month. Think about things like housing, car note, and utilities such as your phone/cable bill. Next, you have your variable expenses. This is because the amount you budget for these expenses can vary from month to month based on your needs. Think about personal care, experiences like dining out, and clothing.

Step 3: Gather paycheck budget resources

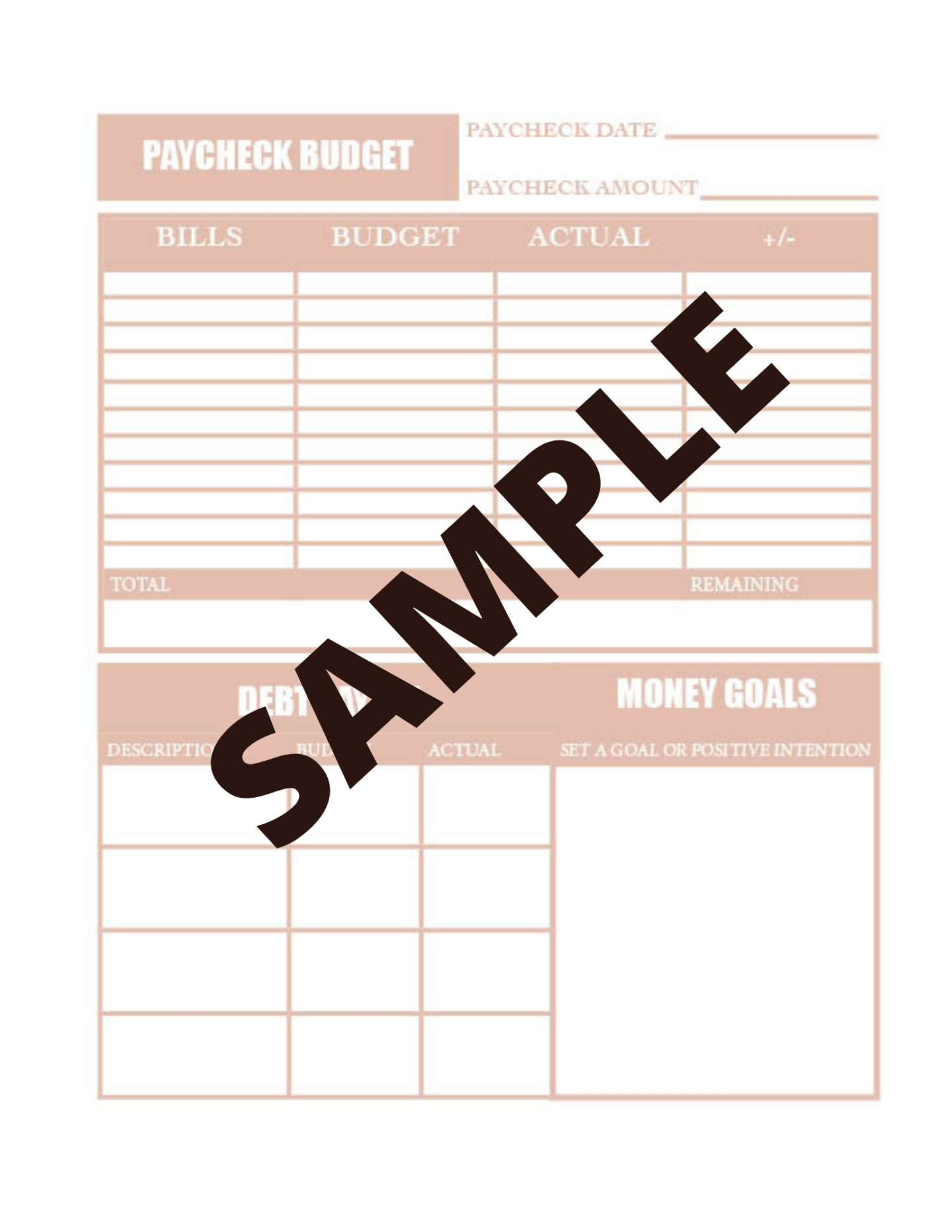

When using the paycheck budget method, it can be helpful to write everything out using a worksheet that you can easily add to your planner or binder.

Next to your bills, you’d write the amount you expect to spend also known as your budgeted amount. Then once you’ve paid that bill you write what you actually spend and if it was greater or less than what you anticipated. This works hand and hand with your budget calendar. You will use the calendar to align with the paycheck period to see which bills you need to pay on what date.

Step 4: Have sinking funds

Your budget is coming together, you can now visually see your spending plan. You know what bills need to be paid when but what about any money that you might have left over? Sinking funds are great for any short-term money goals you might have. Take your hair/nails for instance – an expense you might have to maintain a more polished look. Other sinking funds include car maintenance, travel etc.

Conclusion

I understand that budgeting can feel time-consuming or maybe you just don’t want to sit down and face the truth of your financial situation. But honestly, do you really want to NOT know. The least you can do is try – see how you like it and if it works. The hardest part about budgeting is getting started. But once you find your system it only gets easier with time.